Contribute

Western Wisconsin Health Foundation

Western Wisconsin Health Foundation greatly appreciates the generosity of our donors. Whether you decide to make a one-time donation or choose to defer your gift, we offer many options to help you fulfill your charitable giving goals. Please know that your gift helps us improve the health of our friends and neighbors where we live, work, and play. Thank you for your consideration!

THANKS TO OUR AMAZING 2025 YEAR-ROUND EVENT SPONSORS

WAYS TO GIVE

- Direct Gifts: Cash, Check, Credit Card

- Pledges: Commitments can be paid in monthly or yearly installments over 5 years

- Gifts of Stock

- In-Kind Contributions

- Planned Gifts – now and for the future of WWH

- Memorial or Legacy Gifts

- Volunteering

- Volunteer at the Main Campus – Welcoming and contributing to a better healthcare experience for our community. Click here for more volunteer information.

- Join the Auxiliary – Assisting with fundraisers and events with proceeds benefitting a variety of programs and departments. Click here for more auxiliary information.

Western Wisconsin Health Foundation is a 501(c)(3) nonprofit organization (Tax ID #39-0808526) and your contribution is tax deductible to the fullest extent of the law.

For more information, please visit www.wwhealth.org or contact marketing@wwhealth.org .

Please make checks payable and mail them to:

Western Wisconsin Health Foundation

1100 Bergslien St.

Baldwin, WI 54002

Tax Exempt 501(c)3 Status: 39-0808526

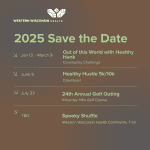

SAVE THE DATE